LIC Tech Term (Plan No 854)

LIC Tech Term Plan 854 is an Online Term Insurance plan of LIC of India which is only available for online sales. It is specially designed taking into consideration the tech-savvy people and the millennials that are more prone to purchase online.

LIC’s Tech-Term is a Non-Linked, Non-participating, Online, Pure Risk Premium Plan which provides financial protection to the insured’s family in case of his/her unfortunate death during the policy term. This plan will be available through the online application process only and can be purchased anytime, anywhere at your convenience.

Key features of LIC Tech Term Plan:

- Flexibility to choose from two benefit options: Level Sum Assured and Increasing Sum Assured.

- Flexibility to Choose from Single-Premium, Regular Premium, and Limited Premium Payment

- Special rates for women.

- Benefits of attractive High Sum Assured Rebate.

- Two categories of premium rates namely (1) Non-Smoker rates and (2) Smoker rates.

- Option to enhance your coverage by opting for Accident Benefit Rider on payment of additional premium for the rider benefit.

The application of Non-Smoker rates shall be based on the findings of the Urinary Cotinine test. In all other cases, the Smoker rates will be applicable.

Unique Identification Number: 512N333V01

Launch Date: 1st September 2019

Options Available under the LIC Tech Term Plan:

Option 1 (Level SA):

- Basic Sum Assured remains same throughout the term.

Option 2 (Increasing SA):

- 10% increase in Basic Sum Assured every year after the completion of 5th years till 15th year till it becomes twice the Basic Sum Assured

- The 10% increase will continue under an in-force policy till the end of policy term, or till the Date of Death or till 15th policy year whichever is earlier.

Maturity Benefit:

- No maturity benefit will be paid under the LIC Tech Term Policy.

DEATH BENEFITS:

Sum Assured on Death is Payable.

For Regular & Limited premium payment policy.

- Death claim will be higher of following

- 7 times of annualized premium or

- 105% of premium paid till death or

- Absolute amount assured.

For Single premium :

- 125% of single premium or

- Absolute amount assured.

The Death Benefit shall be paid in a lump sum as specified above and/or in installments, as per the Settlement option exercised by the Policyholder/Life Assured.

An additional Basic Sum Assured will be payable in case of death due to an accident for an in-force policy if the LIC Accident Benefit Rider has opted.

Income Tax Benefit:

- under section 80C of the Income Tax Act, premiums paid under the LIC’s Tech Term Plan are eligible for a rebate up to the limit of Rs: 1,50,000/-

- under Section 10(10D) of Income Tax Act, The Death claim received by the Nominee under LIC Tech Term Plan is entirely tax-free and no TDS is deductible.

Synopsis of LIC Tech Term Plan:

| Sr. No. | Particulars | Eligibility Condition |

| 1 | Age at entry for Life assured | Minimum – 18 years (last birthday) Maximum – 65 years (last birthday) |

| 2 | Policy Term Premium paying term (Minimum premium will be 3000/- for Regular modes and 30,000/- for Single-Mode) | 10 years to 40 years Regular Premium: Same as Policy Term Limited Premium: Policy Term minus 5 years Policy term minus 10 years, for policy term 15 years to 40 years only. Single premium: Onetime payment. |

| 3 | Maximum Maturity Age | 80 years (last birthday) |

| 4 | Basic Sum assured (in multiples of 5,00,000/- up to 75 lakhs In multiple of 25,00,000/- above 75 lakhs) | Minimum – 50,00,000/- Maximum – No Limit |

| 5 | Mode Loading | Yearly – Nil Half Yearly – 2% of tabular premium |

| 6 | Large Sum Assured rebate | Available (as per Age and Sum assured) |

| 7 | Mode of payment of premiums | Single Payment Yearly Half-yearly |

| 8 | Grace Period | 30 days |

| 9 | Surrender & Policy Loan | No option Available |

| 10 | Revival | Within 5 years from First Unpaid Premium & before Maturity |

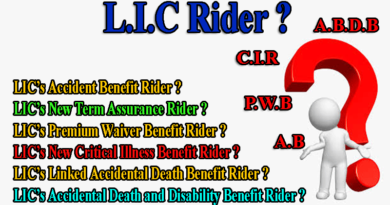

| 11 | Optional Riders Available: | L.I.C’s Accident Benefit Rider |

- For more details about Suicide Clause under LIC Policy visit http://www.punitshet.com/lic-policy-suicide-clause/

Option to take Death Claim Benefits in installment:

- Death Claim Benefits under this plan can be paid to the Nominee in installments provided the option has been exercised by the policyholder. To know more about How to take Death Claim in Installments read: http://www.punitshet.com/take-lic-policyholders-death-claim-amount-in-instalments

How to buy LIC Tech Term Online?

- Log-on to LIC official website at www.licindia.in for buying this online product.

- Click on ‘Buy Policies Online’. Select plan LIC’s Tech-Term.

- Click on ‘Buy Online’. Choose your desired Sum Assured, Sum Assured option (Level/Increasing), Policy Term, Premium Payment option (Regular/Limited/Single), and Premium Payment Mode (Yearly/Half-yearly) for Regular and Limited Premium Payment option, Date of Birth, Gender and Smoking status.

- After filling in the details, a premium calculator will calculate the premium for the chosen parameters.

- Enter other details such as Name, Address, Occupation, Qualification, etc. displayed on the screen and complete the proposal form online.

- Pay premium online and fulfill the underwriting requirements, if any.

Note: The above details are for information purposes only. For more authentic details about the LIC Policy please visit the official LIC website or contact your nearest LIC branch.

Pingback: LIC Insurance Plans as on 15 April 2020 - PunitShet.com