LIC Cancer Cover Plan 905

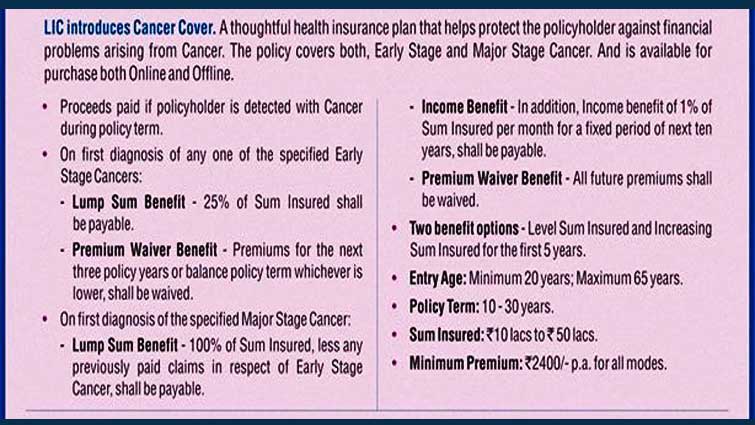

LIC Cancer Cover Plan 905 (UIN: 512N314V01) is a regular premium payment health insurance plan which provides financial protection in case the Life Assured is diagnosed with any of the specified Early and/or Major Stage Cancer during the policy term. LIC Cancer Cover is a non-linked, non-participating, health insurance plan

The plan offers two benefit options wherein you have the flexibility to choose the type of Sum Insured at the inception.

Option I

Level Sum Insured: The Basic Sum Insured shall remain unchanged throughout the policy term.

Option II

Increasing Sum Insured: The Sum Insured increases by 10% of Basic Sum Insured each year for the first five years starting from the first policy anniversary or until the diagnosis of the first event of Cancer, whichever is earlier. On diagnosis of any specified Cancer, all the claims shall be based on the Increased Sum Insured at the policy anniversary coinciding or prior to the diagnosis of the first claim and further increases to this Sum Insured will not be applicable.

The benefits payable under the plan shall be based on the Applicable Sum Insured, where the Applicable Sum Insured shall be equal to-

- The Basic Sum Insured for policies taken under Option I; or

- Basic Sum Insured during the first year and Increased Sum Insured thereafter, as per the provisions detailed in Option II.

LIC CANCER COVER BENEFITS:

The following benefits are payable during the policy year under an in-force policy:

Early Stage Cancer: Benefits payable on first diagnosis of any one of the specified Early Stage Cancers, provided the same is admissible are –

- Lump sum benefit: 25% of Applicable Sum Insured shall be payable

- Premium Waiver Benefit: Premiums for next three policy years or balance policy term whichever is lower, shall be waived from the policy anniversary coinciding or following the date of diagnosis.

Major Stage Cancer: Benefits payable on the first diagnosis of the specified Major Stage Cancer, provided the same is admissible are-

- Lump-Sum: 100% of Applicable Sum Insured less any previously paid claims in respect of Early Stage Cancer shall be payable.

- Income Benefit: In addition to above lump-sum benefit, Income Benefit of 1% of Applicable Sum Insured shall be payable on each policy month following the payment of Lump Sum, for a fixed period of next ten years irrespective of the survival of the Life Insured and even if this period of 10 years goes beyond the policy term. In case of death of the Life Assured while receiving this Income Benefit, the remaining payouts, if any, will be paid to his/her nominee.

- Premium Waiver Benefit: All the future premiums shall be waived from the next policy anniversary and the policy shall be free from all liabilities except to the extent of Income Benefit as specified above.

Benefit Limits and Conditions:

- Early Stage Cancer Benefit shall be payable only once for the first-ever event and Life Assured shall not be entitled to make another claim for the Early Stage Cancer of the same or any other cancer. However, the coverage for the Major Stage Cancer under the policy shall continue until the policy terminates.

- Once a Major Stage Cancer Benefit is paid no payment for any future claims under Early Stage Cancer or Major Stage Cancer would be admissible.

- Total benefit under the Policy including Early Stage Cancer Benefit and Major Stage Cancer Benefit as specified above shall not exceed the maximum claim amount of 220% of Applicable Sum Insured.

- If the life assured claims for different stages of the same Cancer at the same time, the benefit shall only be payable for the higher claim admitted under the policy.

- If there is more than one Cancer diagnosed in an event, the Corporation will only pay one benefit. That benefit will be the amount relating to the stage of Cancer which has the highest benefit amount.

Income Tax Benefit:

under section 80D of the Income Tax Act, premiums paid under the LIC Cancer Cover Plan are eligible for a rebate.

LIC CANCER COVER WAITING PERIOD:

A waiting period of 180 days will apply from the date of issuance of policy or date of revival of risk cover, whichever is later, to the first diagnosis of any stage cancer. “Any stage” here means all stages of Cancer that occur during the waiting period.

No benefit shall be payable if any stage of Cancer occurs before the expiry of 180 days from the date of issuance of policy or date of revival and the policy shall terminate.

SURVIVAL PERIOD:

No benefit shall be payable if the Life Assured dies within a period of 7 days from the date of diagnosis of any of the specified Early Stage Cancer or Major Stage Cancer. The 7 days survival period includes the date of diagnosis.

SYNOPSIS OF LIC CANCER COVER PLAN:

| Sr. No. | Particulars | Eligibility Condition |

| 1 | Age at entry for Life assured | Minimum: 20 years (completed) Maximum: 65 years (last birthday) |

| 2 | Policy Term & Premium paying term | Minimum: 10 years Maximum: 30 years |

| 3 | Maximum Maturity Age | Minimum: 50 years Maximum: 75 years |

| 4 | Basic Sum assured (in multiples of 1,00,000/-) | Minimum – 10,00,000/- Maximum – 50,00,000/- The maximum Basic Sum Insured under this plan shall not exceed an overall limit of Rs.50 lakhs taking all existing Critical Illness Cover policies including Cancer Cover and the Cancer Cover Sum Insured under the new proposal into consideration. |

| 5 | Mode rebate | Nil Mode Loading: Yearly mode – Nil Half-yearly – 2% of Tabular Premium |

| 6 | Large Sum Assured rebate (per 1000 S.A) | NIL |

| 7 | Mode of payment of premiums | Yearly Half-yearly |

| 8 | Grace Period | 30 days |

| 9 | Surrender & Policy Loan | No Surrender Value or Loan is available |

| 10 | Revival | Within 2 years from First Unpaid Premium & before Maturity |

| 11 | Minimum Premium | Rs. 2400/- for all modes |

PREMIUM RATES:

The premium rates under this plan are guaranteed for a period of the first 5 years from the date of issuance of the policy. The Premium rates for future years will be subject to revision based on the Corporation’s experience under this plan and prior notice of at least 90 days to the policyholder.

LIC CANCER COVER EXCLUSIONS:

The Corporation shall not be liable to pay any of the benefits under this product and the policy will stand canceled if the covered conditions resulting directly or indirectly from any of the following causes:

- Any Pre-Existing Condition

- If the diagnosis of a Cancer was made within 180 days from the date of issuance of policy or date of revival of risk cover whichever is later;

- For any medical conditions suffered by the life assured or any medical procedure undergone by the life assured if that medical condition or that medical procedure was caused directly or indirectly by Acquired Immunodeficiency Syndrome (AIDS), AIDS-related complex or infection by Human Immunodeficiency Virus (HIV);

- For any medical condition or any medical procedure arising from the donation of any of the Life Assured’s organs;

- For any medical conditions suffered by the Life Assured or any medical procedure undergone by the Life Assured, if that medical condition or that medical procedure was caused directly or indirectly by alcohol or drug (except under the direction of a registered medical practitioner)

- For any medical condition or any medical procedure arising from nuclear contamination; the radioactive, explosive, or hazardous nature of nuclear fuel materials or property contaminated by nuclear fuel materials or accidents arising from such nature.

Early Stage Cancers covered:

The diagnosis of any of the listed below conditions must be established by histological evidence and be confirmed by a specialist in the relevant field.

Carcinoma-in-situ (CIS): Carcinoma-in-situ means the presence of malignant cancer cells that remain within the cell group from which they arose. It must involve the full thickness of the epithelium but does not cross basement membranes and it does not invade the surrounding tissue or organ. The diagnosis of which must be positively established by microscopic examination of fixed tissues.

Prostate Cancer – early stage: Early Prostate Cancer that is histologically described using the TNM classification as T1N0M0 with a Gleason Score 2 (two) to 6(six).

Thyroid Cancer – early stage: All thyroid cancers that are less than 2.0 cm and histologically classified as T1N0M0 according to TNM classification.

Bladder Cancer – early stage: All tumors of the urinary bladder histologically classified as TaNoMo according to TNM classification.

Chronic Lymphocytic Leukaemia – early stage: Chronic Lymphocytic Leukaemia categorized as stage 0 (zero) to 2 (two) as per the Rai classification.

Cervical Intraepithelial Neoplasia: Severe Cervical Dysplasia reported as Cervical Intraepithelial Neoplasia 3 (CIN3) on cone biopsy.

The following are specifically excluded from all early-stage cancer benefits (Exclusions):

- All tumors which are histologically described as benign, borderline malignant, or low malignant potential

- Dysplasia, intra-epithelial neoplasia or squamous intraepithelial lesions

- Carcinoma in-situ of skin and Melanoma in-situ

- All tumors in the presence of HIV infection are excluded

Major Stage Cancers covered:

A malignant tumor characterized by the uncontrolled growth and spread of malignant cells with invasion and destruction of normal tissues. This diagnosis must be supported by histological evidence of malignancy. The term cancer includes leukemia, lymphoma, and sarcoma.

The following are excluded from major stage cancer benefits (Exclusions):

- All tumors which are histologically described as carcinoma in situ, benign, premalignant, borderline malignant, low malignant potential, neoplasm of unknown behavior, or non-invasive, including but not limited to Carcinoma in situ of breasts, Cervical dysplasia CIN-1, CIN -2 and CIN-3.

- Any non-melanoma skin carcinoma unless there is evidence of metastases to lymph nodes or beyond;

- Malignant melanoma that has not caused invasion beyond the epidermis;

- All tumors of the prostate unless histologically classified as having a Gleason score greater than 6 or having progressed to at least clinical TNM classification T2N0M0

- All Thyroid cancers histologically classified as T1N0M0 (TNM Classification) or below;

- Chronic lymphocytic leukemia less than RAI stage 3

- Non-invasive papillary cancer of the bladder histologically described as TaN0M0 or of a lesser classification,

- All Gastro-Intestinal Stromal Tumors histologically classified as T1N0M0 (TNM Classification) or below and with mitotic count of less than or equal to 5/50 HPFs;

- All tumors in the presence of HIV infection.

Note: The above details are for information purposes only. For more authentic details about the LIC Policy please visit the official LIC website or contact your nearest LIC branch.

Pingback: LIC Insurance Plans as on 15 April 2020 - PunitShet.com