LIC Jeevan Shanti Plan No 850

LIC Jeevan Shanti Plan no 850 is an annuity plan which offers immediate annuity option or deferred annuity option as per the choice of the policyholder at the time of purchasing a new policy. This policy can be purchased under a single-life or under a joint life plan.

LIC Jeevan Shanti is a non-linked, non-participating, single premium annuity plan wherein the Policyholder has an option to choose an Immediate Annuity or Deferred Annuity. This plan shall be allowed to all lives including the third gender. The annuity rates are guaranteed at the inception of the policy for both Immediate and Deferred Annuity. Various annuity options and mode of annuity payment are available under the Plan. The option once selected cannot be changed.

Unique Identification Number: 512N328V01

Launch Date: 11th September 2018

Types of annuities available under LIC Jeevan Shanti:

1) Immediate Annuity: Options available under LIC Jeevan Shanti Immediate Annuity

| Annuity Options | Annuity Description |

| Option A | Immediate Annuity for life |

| Option B | Immediate Annuity with a guaranteed period of 5 years and life thereafter |

| Option C | Immediate Annuity with a guaranteed period of 10 years and life thereafter |

| Option D | Immediate Annuity with guaranteed period of 15 years and life thereafter |

| Option E | Immediate Annuity with a guaranteed period of 20 years and life thereafter |

| Option F | Immediate Annuity for life with return of Purchase Price |

| Option G | Immediate Annuity for life increasing at a simple rate of 3% p.a. |

| Option H | Joint Life Immediate Annuity for life with a provision for 50% of the annuity to the Secondary Annuitant on death of the Primary Annuitant. |

| Option I | Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives. |

| Option J | Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as long as one of the Annuitant survives and return of Purchase Price on death of the last survivor |

2) Deferred Annuity: Options available under LIC Jeevan Shanti Deferred Annuity

| Annuity Options | Annuity Description |

| Option 1 | Deferred annuity for Single life |

| Option 2 | Deferred annuity for Joint life |

Mode of Annuity Payment:

- Yearly

- Half yearly

- Quarterly

- Monthly

The Annuity shall be payable in arrears i.e. the annuity payment shall be after 1 year, 6 months, 3 months and 1 month from the date of commencement of policy for Immediate Annuity options or date of vesting for Deferred Annuity options depending on whether the mode of the annuity payment is Yearly, Half-yearly, Quarterly, and Monthly respectively.

Under Deferred Annuity, change in mode of annuity payments during the deferment period is allowed. Any change in the mode of annuity payment will have to be intimated to the Corporation at least 3 months before the end of the deferment period. Once the annuity payments start, under both Immediate and Deferred Annuity, any change in the mode of annuity payment shall not be allowed.

Benefit Payable on Survival:

1) Under Immediate Annuity:

| Annuity Option | Single/ Joint Life | Benefit payable on Survival |

| A | Single Life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment. |

| B | Single Life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment. |

| C | Single Life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment. |

| D | Single Life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment. |

| E | Single Life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment |

| F | Single Life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment. |

| G | Single Life | Annuity payments will be made in arrears for as long as Annuitant is alive, as per the chosen mode of annuity payment. The annuity payment will be increased by a simple rate of 3% per annum for each completed policy year. |

| H | Joint Life | The applicable annuity will be paid in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment. |

| I | Joint Life | The applicable annuity will be paid in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment. |

| J | Joint Life | The applicable annuity will be paid in arrears for as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment. |

2) Under Deferred Annuity:

| Annuity Option | Single/ Joint Life | Benefit payable on Survival |

| 1 | Single Life | During deferment period: Nothing is payable during the deferment period. After the deferment period: Annuity payments will be made in arrears as long as the Annuitant is alive, as per the chosen mode of annuity payment. |

| 2 | Joint Life | During deferment period: On the survival of the Primary Annuitant and/or Secondary Annuitant during the deferment period, nothing is payable. After the deferment period: Annuity payments will be made in arrears as long as the Primary Annuitant and/or Secondary Annuitant is alive, as per the chosen mode of annuity payment. |

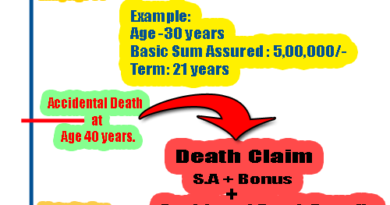

Death benefit:

1) Under Immediate Annuity:

| Annuity Option | Single/ Joint Life | Benefit payable on Death |

| A | Single Life | On the death of the Annuitant, nothing shall be payable. The annuity payment shall cease immediately and the policy will terminate. |

| B | Single Life | On the death of the Annuitant during the guaranteed period of 5 years: The annuity shall be payable to the nominee(s) till the expiry of the guaranteed period. Upon the expiry of this Guaranteed Period, the annuity payments will cease immediately and the policy will terminate. On the death of the Annuitant after the guaranteed period: The annuity payment shall cease immediately and the policy will terminate. |

| C | Single Life | On the death of the Annuitant during the guaranteed period of 10 years: The annuity shall be payable to the nominee(s) till the expiry of the guaranteed period. Upon the expiry of this Guaranteed Period, the annuity payments will cease immediately and the policy will terminate. On the death of the Annuitant after the guaranteed period: The annuity payment shall cease immediately and the policy will terminate. |

| D | Single Life | On the death of the Annuitant during the guaranteed period of 15 years: The annuity shall be payable to the nominee(s) till the expiry of the guaranteed period. Upon the expiry of this Guaranteed Period, the annuity payments will cease immediately and the policy will terminate. On the death of the Annuitant after the guaranteed period: The annuity payment shall cease immediately and the policy will terminate. |

| E | Single Life | On the death of the Annuitant during the guaranteed period of 20 years: The annuity shall be payable to the nominee(s) till the expiry of the guaranteed period. Upon the expiry of this Guaranteed Period, the annuity payments will cease immediately and the policy will terminate. On the death of the Annuitant after the guaranteed period: The annuity payment shall cease immediately and the policy will terminate. |

| F | Single Life | On the death of the Annuitant, the annuity payment shall cease immediately. The Purchase Price shall be payable to the nominee(s) as per the option exercised. |

| G | Single Life | On the death of the Annuitant, nothing shall be payable. The annuity payment shall cease immediately and the policy will terminate. |

| H | Joint Life | On the death of the Primary Annuitant: 50% of the annuity amount shall be payable to the surviving Secondary Annuitant as long as the Secondary Annuitant is alive. The annuity payments will cease on the subsequent death of the Secondary Annuitant and the policy will terminate. If the Secondary Annuitant predeceases the Primary Annuitant: The annuity payments shall continue to be paid and will cease upon the death of the Primary Annuitant and the policy will terminate. |

| I | Joint Life | On first death (of either of the covered lives): 100% of the annuity amount shall continue to be paid as long as one of the Annuitant is alive. On the death of the last survivor: The annuity payments will cease immediately and the policy will terminate. |

| J | Joint Life | On first death (of either of the covered lives): 100% of the annuity amount shall continue to be paid as long as one of the Annuitant is alive. On the death of the last survivor: The annuity payment shall cease immediately. The Purchase Price shall be payable to the nominee(s) as per the option exercised. |

2) Under Deferred Annuity:

| Anniuity Option | Single/ Joint Life | Benefit payable on Death |

| 1 | Single Life | Death Benefit shall be Higher of Purchase Price plus Accrued Guaranteed Additions minus Total annuity payouts till the date of death or 110% of Purchase Price On the death of the Annuitant during the deferment period: Death Benefit as defined above shall be payable to the nominee(s) as per the option exercised by the Annuitant as defined in options available for payment of death benefit. On the death of the Annuitant after the deferment period: The annuity payments shall cease immediately and Death Benefit as defined above shall be payable to the nominee(s) as per the option exercised by the Annuitant as defined in options available for payment of death benefit. |

| 2 | Joint Life | Death Benefit shall be Higher of Purchase Price plus Accrued Guaranteed Additions minus Total annuity payments paid up to date of death or110% of Purchase Price. During the Deferment Period: On first death (of either of the covered lives): Nothing shall be payable. On the death of the last survivor: Death Benefit as defined above shall be payable to the nominee(s) as per the option exercised by the Annuitant(s) as defined in options available for payment of death benefit. After the Deferment Period: On first death (of either of the covered lives): 100% of the annuity amount shall continue to be paid as long as one of the Annuitant is alive. On the death of the last survivor: Annuity payment will cease and Death Benefit as defined above shall be payable to the nominee(s) as per the option exercised by the Annuitant(s) as defined in options available for payment of death benefit. |

Guaranteed Addition under LIC Jeevan Shanti :

- Under Deferred Annuity, Guaranteed Additions shall accrue at the end of each policy month, till the end of the Deferment Period only.

- Guaranteed Additions per month = (Purchase Price * Annuity rate p.a. payable monthly) / 12 Where Annuity rate p.a. payable monthly shall be equal to monthly tabular annuity rate (i.e. 96% * Tabular annuity rate p.a. payable yearly/1000) and shall depend on the age at entry of the annuitant(s) and the deferment period opted for.

- In case of death of the annuitant during the deferment period, Guaranteed Additions for the policy year in which the death has occurred shall accrue till the completed policy month as on the date of death.

- Guaranteed addition will not be calculated under an immediate annuity option.

- Accrued guaranteed addition will not be taken into account for calculating annuity under deferred annuity at the time of taking policy OR at the time of vesting.

- Guaranteed addition will not be taken into account while calculating loan or surrender value under the policy.

Income Tax Benefit:

- under section 80C of the Income Tax Act, premiums paid under the LIC’s Jeevan Shanti Plan are eligible for a rebate up to the limit of Rs: 1,50,000/-

- under Section 10(10D) of Income Tax Act, the Death claim received by the Nominee under LIC Jeevan Shanti Plan is entirely tax-free and no TDS is deductable.

Synopsis of LIC Jeevan Shanti Plan:

| Sr. No. | Particulars | Eligibility Condition |

| 1 | Age at entry for Life assured | Minimum – 30 years (completed) Maximum – Immediate Annuity 85 years (last birthday) except Option F 100 YEARS (last birthday) for Option F Deferred Annuity 79 years(last birthday) |

| 2 | Deferment Period | Minimum: 1 year Maximum: 20 years |

| 3 | Vesting Age for Deferred Annuity | Minimum: 31 years(last birthday) Maximum: 80 years(last birthday) |

| 4 | Purchase Price | Minimum – 1,50,000/- * Subject the minimum pension of 1000/- Monthly, 3,000/- Quarterly, 6000/- Half yearly & 12,000/- Yearly. Maximum – Unlimited |

| 5 | Joint Life Scope | Joint life Annuity can be taken between any lineal Descendant/ Ascendant of the family ( i.e. grandparent, parent, children, grandchildren) OR Spouse OR Siblings. |

| 6 | Large Purchase Price rebate | Available |

| 7 | Reduction in Annuity as per Mode of Annuity in Deferred Option | Yearly: Nil Half-yearly: 2% Quarterly: 3% Monthly: 4% |

| 8 | Grace Period | Not Applicable (Single Premium) |

| 9 | Surrender & Policy Loan | Allowed as per special terms and condition |

| 10 | Revival | Not Applicable |

| 11 | Optional Riders Available: | Not Available |

Incentive for high purchase price

Under both Immediate Annuity and Deferred Annuity policies, where the purchase price is high, incentive by way of increase in the tabular annuity rate will be given to the annuitant.

Scale of the absolute amount of incentive under high purchase price policies as an addition to the annuity rates per annum per rupees one thousand purchase price is as below.

| Mode of Annuity | 5,00,000 to 9,99,999 | 10,00,000 to 24,99,999 | 25,00,000 to 49,99,999 | 50,00,000 To 99,99,999 | 1,00,00,000 & above |

| Yearly | 1.50 | 2.10 | 2.45 | 2.60 | 2.70 |

| Half Yearly | 1.40 | 2.00 | 2.35 | 2.50 | 2.60 |

| Quarterly | 1.35 | 1.95 | 2.30 | 2.45 | 2.55 |

| Monthly | 1.30 | 1.90 | 2.25 | 2.40 | 2.50 |

LIC JEEVAN SHANTI for NRI & FNIOs:

The Immediate Annuity Option under the plan is allowed to NRIs residing in any of the groups without charging any residence extra. The Deferred Annuity Option under the plan is allowed to NRIs residing in Residence Group V only.

The plan is not available to Foreign Nationals of Indian Origin.

- For more details about Suicide Clause under LIC Policy visit http://www.punitshet.com/lic-policy-suicide-clause/

Option to take Death Claim Benefits in installment:

- Death Claim Benefits under this plan can be paid to the Nominee in installments provided the option has been exercised by the policyholder. To know more about How to take Death Claim in Installments read: http://www.punitshet.com/take-lic-policyholders-death-claim-amount-in-instalments

Note: The above details are for information purposes only. For more authentic details about the LIC Policy please visit the official LIC website or contact your nearest LIC branch.

Pingback: LIC policy for DivyangJan: LIC Jeevan Shanti an overview! - PunitShet.com