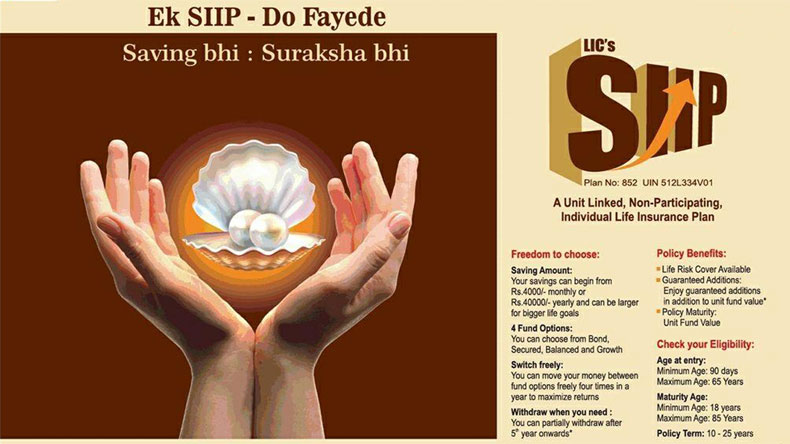

LIC SIIP (PLAN No 852) Unit Linked Insurance Plan

LIC SIIP Plan No 852, is a Regular Premium, Non-Participating, Unit Linked Assurance Plan, which offers insurance-cum-investment. Proposer can choose the amount of premium one desires to pay. Each premium paid shall be subject to allocation charges. Upon completion of a specified duration, guaranteed additions as a percentage of one Annualized Premium shall be added to the unit fund under the in-force policy.

Unique Identification Number: 512L334V01

Launch Date: 02/03/2020

LIC SIIP Maturity Benefit:

Unit Fund Value + Refund of Mortality Charges (Excluding any extra premium and Taxes on Mortality Charges)

- On the Life-Assured surviving the stipulated Date of Maturity

- an amount equal to the total amount of mortality charges deducted in respect of life insurance cover shall be payable along with the Maturity Benefit provided all due premiums under the policy have been paid.

Death benefit:

On death Before the Date of Commencement of Risk:

- An amount equal to the Unit Fund Value shall be payable.

On death After the Date of Commencement of Risk:

An amount equal to the highest of the following shall be payable

- Basic Sum Assured reduced by Partial Withdrawals made during the two years period immediately preceding the date of death; or

- Unit Fund Value; or

- 105% of the total premiums received up to the Date of Death reduced by Partial withdrawals made during the two years period immediately preceding the date of death

- Where Basic Sum Assured is equal to ‘10 times of Annualized Premium in case age at entry of Life Assured is below 55 years and

- 7 times of Annualized Premium in case age at entry of Life Assured is 55 years and above

- and Partial Withdrawal reduced

- The Death Benefit shall be paid in a lump sum as specified above and/or in installments, as per the Settlement option exercised by the Policyholder/Life Assured.

Income Tax Benefit:

- under section 80C of the Income Tax Act, premiums paid under the LIC’s SIIP Plan are eligible for a rebate up to the limit of Rs: 1,50,000/-

- under Section 10(10D) of Income Tax Act, The Survival benefit and Maturity benefit received by the policyholder or the Death claim received by the Nominee under LIC SIIP Plan will be exempted or taxed as per prevailing Income tax rules.

LIC SIIP Guaranteed Additions:

Guaranteed Additions as a percentage of one Annualized Premium, as mentioned in the table below shall be added to the Unit fund on completion of a specific duration of policy years provided all due premiums have been paid and the policy is in force.

| End of Policy Year | Guaranteed Additions (as percentage of one Annualized Premium) |

| 6 | 5% |

| 10 | 10% |

| 15 | 15% |

| 20 | 20% |

| 25 | 25% |

- The allocated Guaranteed Addition shall be converted to units based on NAV of the underlying fund type as on the date of such addition and shall be credited to the Unit Fund.

- For policies that are not in force but revived subsequently, Guaranteed Addition shall be credited on the date of revival of the policy, provided all due premiums have been paid.

- any Guaranteed Addition added subsequent to the date of death (in case of delay in intimation of death claim) shall be recovered from the Unit Fund.

LIC SIIP Partial Withdrawals:

A Policyholder can partially withdraw the units at any time after the fifth policy anniversary and provided all due premiums till date of partial withdrawal have been paid, subject to the following:

- In the case of minors, partial withdrawals shall be allowed only after Life Assured is aged 18 years or above.

- The Partial withdrawals may be in the form of a fixed amount or in the form of a fixed number of units.

- Maximum amount of Partial Withdrawal as a percentage of the fund during each policy year shall be as under:

| Policy Year | Percent of Unit Fund |

| 6th to 10th | 20% |

| 11th to 15th | 25% |

| 16th to 20th | 30% |

| 21st to 25th | 35% |

- The above Partial withdrawal shall be allowed subject to minimum balance remaining after allowing for partial withdrawal is not less than 3 annualized premiums. The partial withdrawals which would result in termination of a contract shall not be allowed.

- Partial withdrawal charge as specified shall be deducted from the Unit Fund Value.

- If partial withdrawal has been made then for two years period immediately from the date of withdrawal, the Basic Sum Assured or Paid-up Sum Assured, whichever is applicable, shall be reduced to the extent of the amount of partial withdrawals made. On completion of two years period from the date of withdrawal the original Basic Sum Assured/Paid-up Sum Assured shall be restored.

Synopsis of LIC SIIP Plan:

| Sr. No. | Particulars | Eligibility Condition |

| 1 | Age at entry for Life assured | Minimum – 90 days (completed) Maximum – 65 years (nearer birthday) |

| 2 | Policy Term & Premium paying term | 15 years to 25 years |

| 3 | Maturity Age | Minimum: 18 years (completed) Maximum: 85 years(nearer birthday) |

| 4 | Minimum Premium Amount | Yearly: 40,000/- Half-yearly: 22,000/- Quarterly: 12,000/- Monthly(NACH): 4000/- |

| 5 | Basic Sum Assured | Age below 55 years: 10 times annualized premium Age 55 years and above: 7 times annualized premium. |

| 6 | Rebate | Nil |

| 7 | Mode of payment of premiums | Yearly Half-yearly Quarterly Monthly(NACH) |

| 8 | Grace Period | 30 days for Yrly/H-Yrly/Qtrly modes 15 days for Monthly modes |

| 9 | Surrender Policy Loan | Surrender /Paid Up after 5 years No Policy Loan Available |

| 10 | Revival | Within 3 years from First Unpaid Premium & before Maturity |

| 11 | Optional Riders Available: | L.I.C’s Linked Accidental Benefit Rider |

Date of commencement of risk:

- Applicable only if the age of Life Assured is less than 8 years

- In case the age at entry of the Life Assured is less than 8 years (last birthday), the risk under this plan will commence either one day before the completion of 2 years from the date of commencement of policy or one day before the policy anniversary coinciding with or immediately following the completion of 8 years of age, whichever is earlier.

- For those aged 8 years or more at entry, risk will commence immediately from the date of issuance of the policy.

Fund Unit Allocation and Investment of Fund:

1) Unit Fund:

The allocated premiums will be utilized to buy units as per the fund type opted by the Policyholder out of the four fund types options available. Various types of fund options and broadly their investment patterns are as under:

| Fund Type | Investment in Government / Government Guaranteed Securities / Corporate Debt | Short-term investments such as money market instruments | Investment in Listed Equity Shares | Objective | Risk Profile |

| Bond Fund | Not less than 60% | Not more than 40% | Nil | To provide relatively safe and less volatile investment option mainly through accumulation of income through investment in fixed income securities. | Low risk |

| Secured Fund | Not less than 45% and not more than 85% | Not more than 40% | Not less than 15% and Not more than 55% | To provide steady income through investment in both equities and fixed income securities. | Lower to Medium risk |

| Balanced Fund | Not less than 30% and not more than 70% | Not more than 40% | Not less than 30% and Not more than 70% | To provide balanced income and growth through similar proportion investment in both equities and fixed income securities. | Medium risk |

| Growth Fund | Not less than 20% and not more than 60% | Not more than 40% | Not less than 40% and Not more than 80% | To provide long term capital growth through investment primarily in equities. | High risk |

The Policyholder will have the option to choose any ONE of the above 4 funds to invest his premiums.

2) Discontinued Policy Fund :

The investment pattern of the Discontinued Policy Fund shall have the following asset mix:

- Money market instruments: 0% to 40%

- Government securities: 60% to 100%

LIC SIIP Charges:

1) LIC SIIP Premium Allocation Charge:

This is a percentage of the premium appropriated towards charges from the premium received. The balance known as allocation rate constitutes that part of the premium which is utilized to purchase units for the policy.

The allocation charges are as below:

| Year | Premium Allocation Charge in % |

| First Year: | 8.00% |

| 2nd to 5th Year: | 5.50% |

| Thereafter: | 3.00% |

2) Mortality Charge:

- the cost of Life Insurance cover will be taken at the beginning of each policy month by canceling the Unit Fund Value appropriately

3) Accident Benefit Charge:

- cost of LIC’s Linked Accidental Death Benefit Rider (if opted for) levied at the beginning of each policy month by canceling appropriate number of units out of the Unit Fund Value.

4) Other Charges:

- LIC SIIP Fund Management Charge: This is a charge levied as a percentage of the value of assets and shall be appropriated by adjusting the NAV. Fund Management Charge (FMC) shall be as under:

- 1.35% p.a. of Unit Fund for all the four fund types available under an in-force policy i.e. Bond Fund, Secured Fund, Balanced Fund, and Growth Fund

- 0.50% p.a. of Unit Fund for “Discontinued Policy Fund”

- This is a charge levied at the time of computation of NAV, which will be done on a daily basis. The NAV thus declared will be net of FMC.

- Switching Charge: This is a charge levied on switching of monies from one fund to another and will be levied at the time of effecting a switch. Within a given policy year, 4 switches shall be allowed free of charge. Subsequent switches, if any, shall be subject to a Switching Charge of Rs. 100 per switch.

- Discontinuance Charge: This charge will be levied by canceling appropriate number of units from the Unit Fund Value as on the date of discontinuance of Policy. The Discontinuance charge applicable is as under:

| Where the policy is discontinued during the policy year | Discontinuance Charges for the Policies having annualized premium up to Rs 50,000 | Discontinuance Charges for the Policies having annualized premium above Rs 50,000 |

| 1 | Lower of 20% multiplied by (AP or FV) subject to maximum of Rs. 3000/- | Lower of 6% multiplied by (AP or FV) subject to maximum of Rs. 6000/- |

| 2 | Lower of 15% multiplied by (AP or FV) subject to maximum of Rs. 2000/- | Lower of 4% multiplied by (AP or FV) subject to maximum of Rs. 5000/- |

| 3 | Lower of 10% multiplied by (AP or FV) subject to maximum of Rs. multiplied by 1500/- | Lower of 3% multiplied by (AP or FV) subject to maximum of Rs. 4000/- |

| 4 | Lower of 5% multiplied by (AP or FV) subject to maximum of Rs. 1000/- | Lower of 2% multiplied by (AP or FV) subject to maximum of Rs. 2000/- |

| 5 and onwards | NIL | NIL |

- AP – Annualized Premium

- FV – Unit Fund Value on the Date of Discontinuance of Policy

“Date of Discontinuance of the Policy” shall be the date on which the intimation is received from the Life Assured/ policyholder about surrender of the policy or on the expiry of the Grace Period (in case of non-payment of contractual premium due during the Grace Period),, whichever is earlier.

- LIC SIIP Partial Withdrawal Charge: This is a charge levied on the Unit Fund Value at the time of partial withdrawal of the fund and shall be a flat amount of Rs. 100/- which will be deducted by canceling the appropriate number of units out of Unit Fund Value and the deduction shall be made on the date on which partial withdrawal takes place.

- Tax Charge: Tax charge, if any, will be as per the prevailing tax laws and rate of tax as applicable from time to time. Tax Charge shall be levied on all or any of the charges applicable to this plan as per the prevailing Tax laws/ notification etc. as issued by the Government of India or any other Constitutional Tax Authority of India from time to time in this regard without any reference to the policyholder.

- Miscellaneous Charge: This is a charge levied for an alteration within the contract, such as a change in premium mode, and Grant of Accident Benefit Rider after the issue of the policy, and shall be a flat amount of Rs. 100/- which will be deducted by canceling the appropriate number of units out of Unit Fund Value and the deduction shall be made on the date of alteration in the policy.

The Corporation reserves the right to accept or decline an alteration in the policy. The alteration shall take effect from the policy anniversary coincident with or following the alteration only after the same is approved by the Corporation and is specifically communicated in writing to the policyholder.

- Right to revise charges: The Corporation reserves the right to revise all or any of the above charges except, Mortality Charge and Accident Benefit Charge. The modification in charges will be done with prospective effect with the prior approval of IRDAI and after giving the policyholders a notice of 3 months which shall be notified through our website.

Although the charges are reviewable, they will be subject to maximum charges as declared by IRDAI from time to time. The current cap on charges is as under:

- Premium Allocation charges shall not exceed 12.5% of Annualized Premium in any year

- The Fund Management Charge shall not exceed the limit specified by IRDAI.

- Partial withdrawal charge shall not exceed Rs. 500/- on each withdrawal.

- Switching Charge shall not exceed Rs. 500/- per switch.

- Discontinuance charges shall not exceed the limits specified by IRDAI.

- Miscellaneous charges shall not exceed Rs. 500/- each time when an alteration is requested.

In case the Policyholder does not agree with the revision of charges the policyholder shall have the option to withdraw the Unit Fund Value. If such revision in charges is made during the Lock-in-Period, withdrawal shall be allowed only after the expiry of Lock-in-Period.

- For more details about Suicide Clause under LIC Policy visit http://www.punitshet.com/lic-policy-suicide-clause/

Option to take Death Claim Benefits in installment:

- Death Claim Benefits under this plan can be paid to the Nominee in installments provided the option has been exercised by the policyholder. To know more about How to take Death Claim in Installments read: http://www.punitshet.com/take-lic-policyholders-death-claim-amount-in-instalments

Note: The above details are for information purposes only. For more authentic details about the LIC Policy please visit the official LIC website or contact your nearest LIC branch.